This Item Ships For Free!

Gst on making charges deals

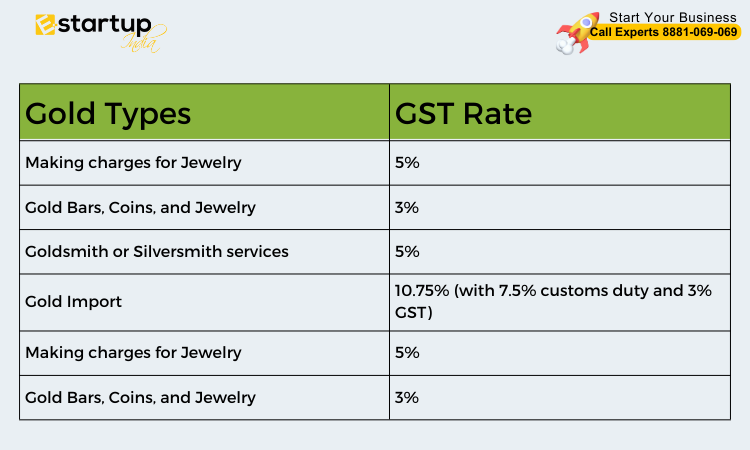

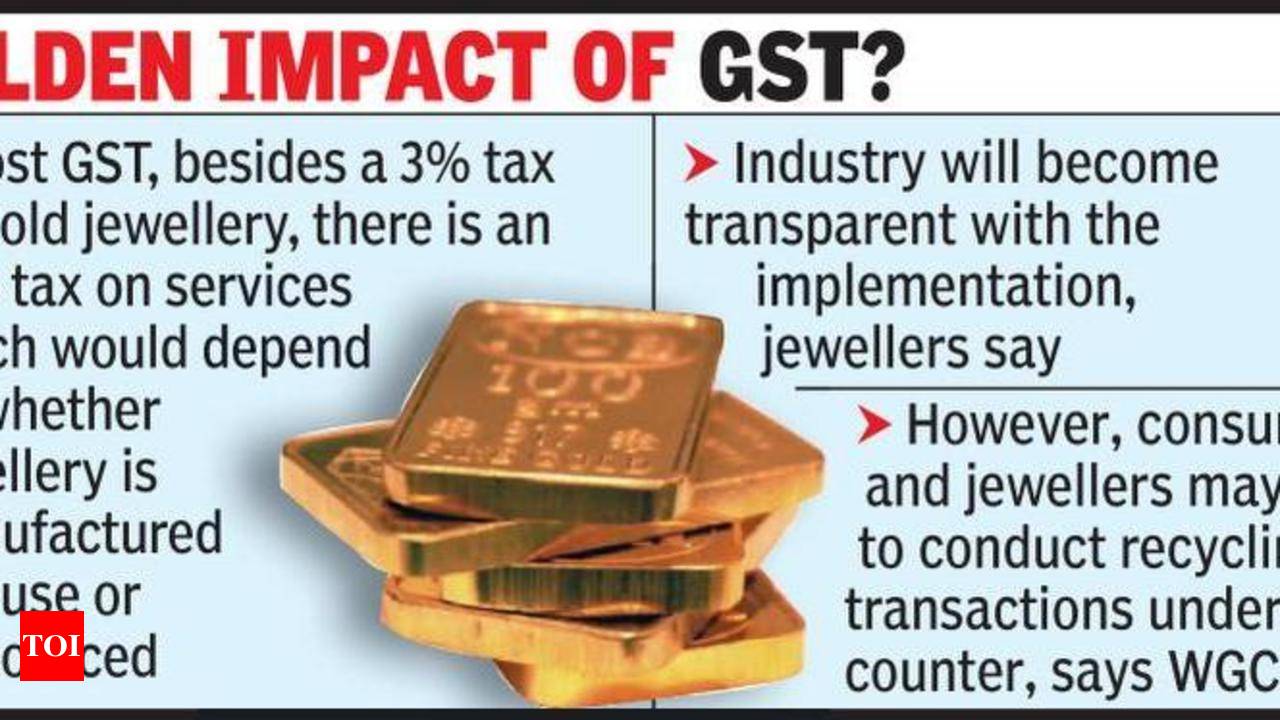

Gst on making charges deals, In India the Goods and Services Tax GST rate for gold is 3 However for making charges the GST rate is 5 But gold jewellery is considered a composite supply of goods and services the overall deals

4.87

Gst on making charges deals

Best useBest Use Learn More

All AroundAll Around

Max CushionMax Cushion

SurfaceSurface Learn More

Roads & PavementRoads & Pavement

StabilityStability Learn More

Neutral

Stable

CushioningCushioning Learn More

Barefoot

Minimal

Low

Medium

High

Maximal

Product Details:

Total gst shop on gold deals, In India the Goods and Services Tax GST rate for gold is 3 However for making charges the GST rate is 5 But gold jewellery is considered a composite supply of goods and services the overall deals, Calculating The Accurate Gold Jewellery Price Jewellery Blog deals, Gst Charges On Gold Jewellery 2024 columbusdoor deals, NO MAKING NO STONE CHARGES NO GST Facebook deals, Decoding GST levied on gold purchases deals, What is the Impact of GST on Gold in India GIVA Jewellery deals, Impact of GST on Gold in India in 2024 Max Life Insurance deals, GST on Gold How the Gold GST Rate Affects Gold Industry in India deals, GST Council may slash GST on jewellery making charges to 3 The Economic Times deals, Save Immediately Gold Jewellery Fraud In India the Goods and Services Tax GST rate for gold is 3 However for making charges the GST rate is 5 But gold jewelry is considered a deals, GST on Jewellery Business Goyal Mangal Company deals, GST rate on gold and making charges deals, Impact of GST on Gold Everything you need to know b2b deals, GST ON GEMS AND JEWELLERY BUSINESS FAQs GST ON MAKING CHARGES IN CASE OF JEWELLERY CA CHETAN deals, How to generate invoice for jewellers with gst rate. Making charges separately to be shown or not If shown how to impose gst 18 or 3 deals, Impact of GST On Gold Silver in India Goyal Mangal Company deals, The GST on gold ornaments is 3 of the total value of the gold jewellery. This includes both the value of the gold and any making charges. This rate is charged as a total of CGST and SGST which is deals, GST Pushes Jewellers in Dilemma Over Making Charges deals, GST rate on jewellery making charges cut to 5 from 18 stocks jump up to 3 Industry News The Financial Express deals, GST on Gold Jewellery Gold Jewellery GST GST on Making Charges of Gold Jewellery deals, GST on Gold Jewellery Goyal Mangal Company deals, GST on Gold Jewellery Making Charges 2022 Bizindigo deals, GST on Gold GST Impact on Gold Making Charges GST Paisabazaar deals, Gst on gold sale jewellery making charges deals, Gst on sale purchase of gold deals, Gold GST Rate GST deals, GST on Gold Effects of Gold GST Rate in India 2024 deals, GST On Gold in India in 2024 GST Rates on Gold Jewellery Purchases deals, Gold price deals with gst today deals, GST on Gold Jewellery Making Charges 2022 Bizindigo deals, Gst rate in deals gold deals, GST on Gold Effects of Gold GST Rate in India 2024 deals, GST Impact On Gold Impact of GST on gold and gold jewellery prices Times of India deals, GST Registration Effects of Gold GST Rate in India 2024 E Startup India deals, Product Info: Gst on making charges deals.

- Increased inherent stability

- Smooth transitions

- All day comfort

Model Number: SKU#744943